Day 92 in MIT Sloan Fellows Class 2023, Financial Management 9, Summary of business cases and financial theories - 4

- Dixons

- Key concepts

- key findings

- Concoleum

- Key concepts

- LBO

- Go private

- Use assets to borrow against finance purchase of equity

- High leverage needs stable cash flows

- High depreciation and interest payment mean high tax shield

- High management incentives. LBO significantly reduce agency costs because management now is owner.

- Do IPO again when it loses depreciation and interest ta sheild.

- Strip finance vs Tiered Finance

- Strip finance is to get equity actually, but call it "debt".

- No conflict among priority claim holders

- With this finance, the market allows future mega deals.

- Lower interest rate and real debt is lower percentage, but it seems to be very high leverage.

- LBO

- Key Findings

- Target company profile

- Some future certain risk such as patent expiration

- Low P/E

- Excess cash

- Low product market risk by low entry barrier and high liquidity (different from AT&T)

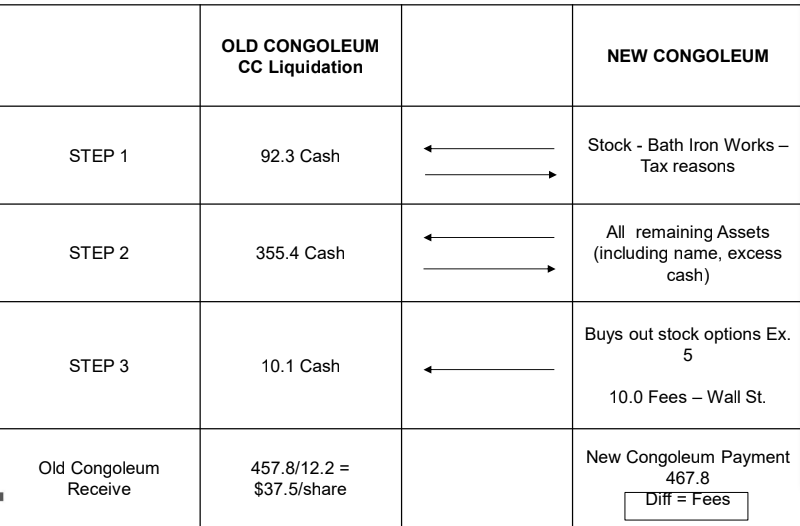

- How to exchange cash?

- Old company's stock(only one division)

- Remaining assets

- Stock options

- All the cash was paid as payment of new Congoleum. Difference between the cash received by old Congoleum is fee for investment bank.

-

Financing

- Target company profile

- Key concepts