Day 56 in MIT Sloan Fellows Class 2023, Managerial Finance3, Capital Budgeting

NPV rule

- For a single project, take it only if it has a positive NPV.

- For many independent projects, take all those with positive NPV.

- For mutually exclusive projects, take the one with the highest positive NPV.

- If there is synergy between projects, calculate all the patterns and take the combination of projects with the highest positive NPV

EBIT and EBITDA

- EBIT = EBITDA - Depreciation

Tax would matter in all the cases.

We should use EBIT if we need simpler calculations, but EBITDA is typical because it would be profit before interest payment and tax payment.

Calculation of NPV: Cash Flow

t=tax rate

- CF=(1-t)*EBITDA + t*Depreciation - Capital Expenditures - Changes in Working Capital

- CF=(1-t)*EBIT + Depreciation - CapEx - ΔWC

- ΔWC =ΔInventory + ΔA/R - ΔA/P

Alternatives to NPV

The drawbacks of these projects are as follows.

- They tend to ignore the scale of projects

- They do not work well for multiple projects portfolio

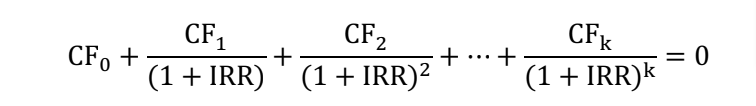

Internal rate of return (IRR) is the discount rate that makes the project’s NPV equal to zero.

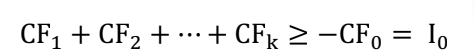

Payback period is the minimum length of time such that sum of cash flows from a project is positive.

Discounted payback period addresses the shortcoming of ignoring time value of money of the Payback period

Profitability index (PI) is the ratio of the net present value of future cash flows to the initial cost of a project