Day 117 in MIT Sloan Fellows Class 2023, M&A and PE 4 "Spin off"

Spin off basics

Nowadays, a lot of companies simplify their business and improve the clarity of business. This kind of simplification through spin-off and split-off opposed to diversification has frequently been examined in the healthcare sector and by conglomerates such as GE.

Basically, the parent and subsidiary need to think about three - four options

- Remain a part of a parent company

- Spin off and live as an independent company

- Spin off and be a part of the similar company ( with more synergy)

- Spin off and acquired by PE/fund

History of spin-off

The most famous one is Marathon.

USX to Split U.S. Steel, Marathon Oil In Response to Shareholder Pressure - WSJ

It demonstrated the company prioritized internal investments and became a target of hostile mergers/activities.

It became a subsidiary of US steal as well.

These grouping and ungrouping frequently happen in the corporate world. However, how do management and shareholders evaluate those actions?

Product portfolio macro and micro

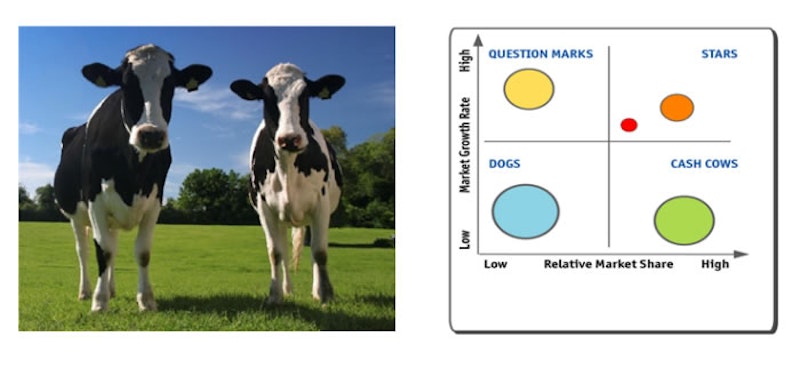

Thinking about a diversification portfolio is like thinking product market portfolio originally from BCG consultants. Then, we need to think about synergy and integration between businesses.

From a macro perspective, the argument is pretty simple.

- Operating separately or fully integrated. Which way maximize shareholders' value?

But from a micro perspective, we need to consider

- individual company's performance and capital structure.

Several ways of spin-off(US)

If you want to sell your company to others as a spinoff, there are several ways to do that. And, of course, each way has its own pros/cons.

- Classic sale: tax target, immediate cash payment

- 355 spin-off: avoid tax, 50% share holding by parent company shareholder

- 355 split-off: parent company shareholder can choose "exchanging parent company shares with new company shares."

- IPO curve-put: Getting cash from public market. The parent company need to have at least 80% voting control.

- Morris Trust Transaction: More complicated deal in 355 split-off.

How it works in more practical context

There are more practical common risks of spin-offs. In any cases, equity stories really matter.

- Separation process becomes a distraction and base business suffers

- Insufficient change made pre-spin to re-shape the business and account for dis-synergies

- Too many people activated early-on in the separation process before the separation thesis is well defined. Then, chaos emerges

- Executive time spent on process and function-led items vs strategic and cross-functional issues

- No compelling vision of the future is painted missing the opportunity to enroll people in the future.

Then, as a consequence, the following disruptions would happen

- Pre-spin business suffers, activist involvement, spin in jeopardy

- Combined enterprise value shrinks post-spin; Growth slows, margins and multiples contract

- Organizational churn, minimal early progress, critical decisions delayed

- Critical decisions delayed, which defaults to everything being clone and copied

- Talent departs, attracting new talent is difficult

Integration might be dangerous

One of controversial examples is Kelogg spinoff.

Kellogg Company Announces Plan To Separate Into Three Independent Publicly Traded Companies

It has a highly integrated supply chain, so it might turn into a dis-synergetic spinoff.