Day 59 in MIT Sloan Fellows Class 2023, Managerial Finance4, Bonds-1

Fixed income markets:

-

- Issuers: entities that create fixed-income securities in order to raise funds (e.g.,governments, corporations, commercial banks, states, municipalities)

- Intermediaries: entities that assist issuers in creating and selling fixed-income securities(e.g., dealers, investment banks, credit-rating agencies)

- Investors: entities that buy fixed-income securities (governments, pension funds,insurance companies, individuals)

- Bonds: a type of fixed-income security. They are described by their

- Maturity: the amount of time at which the last payment on a bond is due.

- Face-value: the value of a bond that appears on its face and that will be paid to the investor by the issuer at maturity, also referred to as par value or principal.

- Coupon: the interest charged on a bond’s face value while maturity is not reached.Bonds can have a coupon (coupon bonds) or not (zero-coupon bonds).

- Collateral: assets that are pledged as security for payment of debt.

- Spot interest rates: the current appropriate interest rate for discounting a cashflow at a period t, expressed as rt.

Zero coupon bonds

They are bonds without any coupon payments, also known as discount bonds.

The price P of zero-coupon bonds provide information about "spot interest rates".

Coupon bonds

bonds with coupon payments before its maturity.

- Cash flows of coupon bonds depend only on their maturity, face value, and coupons.

- A coupon bond with maturity date T and face value of F and scheduled annual coupon payments of C t has the following cashflows:

Yield-to-maturity(YTM)

The yield-to-maturity (YTM) is the discount rate y which when used at all time horizons results in the same bond price.

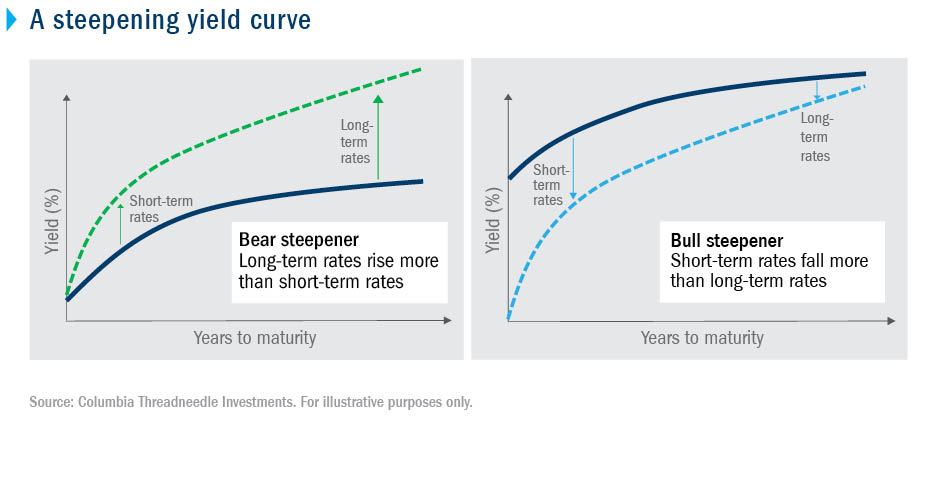

Yield curve describes set of yields that exist on bonds of different maturities.

Expectations Hypothesis(EH)

The EH is a model which seeks to explain variation in the term

structure of interest rates. The key idea is that the long-term interest rate is a geometric average of current and expected future short-term rates.If investors regard long-term bonds as riskier than short-term bonds, for instance due to a lack of liquidity, they will require a higher return (compensation for risk).

Duration

Duration is the weighted-average timing of the cashflows of a bond. Changes in interest rates introduce two potentially offsetting effects for a long-term investor:

- Price effects: increases in interest rates lead the value of existing fixed income positions to decline, lowering the investor’s wealth today, making them worse off.

- Reinvestment effects: Any new investments (e.g., as existing securities mature and are replaced with new ones or new contributions are made) earn higher returns.This can make investors better off by increasing the growth rate of future wealth.

Duration shortcuts:

- The duration of a portfolio is the weighted average of the duration of its components

- The duration of a perpetuity is: (1+y)/y

- The duration of a zero-coupon bond is its maturity

- The duration of a coupon bond is always lower than its maturity

To set the same duration of liabilities and assets, you can avoid inflation risk.